The Department of Finance announced the automobile expense deduction limits and the prescribed rates for automobile operating expense benefits that will apply for the 2024 taxation year. This year’s announcement contains a few changes from the 2023 limits and rates. These rates, effective January 1, 2024, will be as follows:

- The limit on tax-deductible per kilometre allowances paid to employees for using their personal vehicles for business purposes increases by two cents to 70 cents per kilometre for the first 5,000 kilometres and to 64 cents per kilometre thereafter. The rates are four cents per kilometre higher in the Northwest Territories, Nunavut, and Yukon;

- The capital cost allowance limit for passenger vehicles purchased in 2024 will increase by $1,000 to $37,000, plus applicable federal and provincial sales taxes, and the limit for eligible zero-emission passenger vehicles (CCA class 54) will remain at $61,000. This results in a maximum allowable input tax credit (ITC) of $1,850 for GST paid ($4,810 or $5,550 for HST paid at 13% or 15%, respectively) for a passenger vehicle acquired in 2024 that is not a zero-emission passenger vehicle;

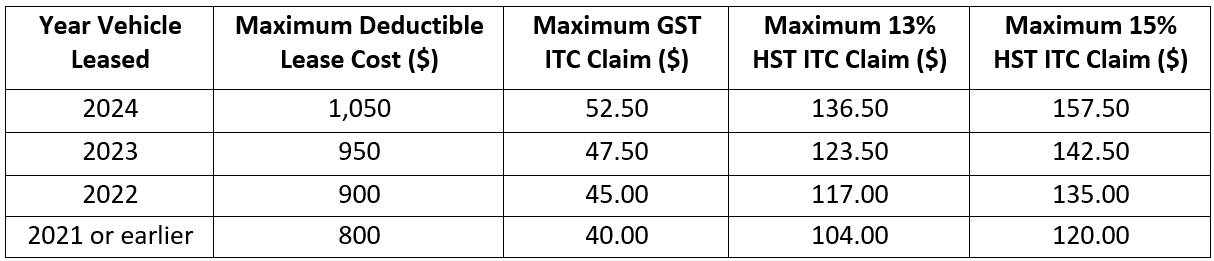

- The limit on deductible leasing costs will increase by $100 to $1,050 per month (plus applicable federal and provincial sales taxes) for leases entered into in 2024. Thus, the maximum allowable ITC that may be claimed for GST paid in respect of an automobile lease entered into in 2024 is $52.50 per month for GST paid ($136.50 or $157.50 for HST at 13% or 15%, respectively); and

- The general prescribed rate used to determine the taxable benefit relating to the personal portion of the operating costs of an employer-provided automobile will be 33 cents per kilometre, which is the same rate that was in place for 2023. For taxpayers employed principally in the selling or leasing of automobiles, the prescribed rate will also remain unchanged in 2024 at 30 cents per kilometre.

Please note it is the year in which the lease is entered into and not the year in which the lease payments are made that determines the lease limits. The allowable lease limit for a lease entered into before January 1, 2022, is $800; for leases starting in 2022, it is $900; and for a similar lease entered into during 2023, it is $950. The changing of the deductible lease limits over the past few years can lead to confusion when taxpayers claim ITCs on the GST/HST that applies to automobile leases and the lease commencement dates range from 2021 (or earlier) to 2024. The chart below should help to ease this potential confusion:

The news release may be accessed at the following link: 2024 Automobile Limits

- Topics

- Income Tax

- Sales Tax

- Transportation

- Federal