Receipts and Expenditure (R&E) Valuation: Is Your Business Facing Unfair Rate Hikes?

The 2026 draft local rating lists have revealed a critical flaw in the business rates system: a widespread over-reliance on the receipts and expenditure (R&E) valuation method. Sectors from hospitality and leisure to transport and utilities are facing staggering increases in their rateable values (RVs). It is the result of the methodology itself, the strength of the post-COVID antecedent valuation date (AVD), and the longstanding reliance on the shortened version of the method in the absence of robust rental evidence.

While the government has launched a review, any changes will not take effect until 2029. This leaves thousands of businesses exposed to potentially inflated tax bills for the entire 2026–2029 cycle. Understanding this challenge is the first step toward protecting your business.

The Problem with the Shortened R&E Method

Originally limited in its scope, the R&E method is now applied to a vast range of properties, including hotels, pubs, airports, arenas, museums, and sports stadiums. The Valuation Office Agency (VOA) frequently uses a “shortened” version of this method for consistency and speed. However, this approach has been strongly criticised by the courts.

Today, the method governs valuations for:

- Hotels (from global brands to independent operators)

- Arenas, leisure destinations, theme parks, and major visitor attractions

- Airports and aviation infrastructure

- Energy, water, and waste utilities

- Railway undertakings, ports, and transport assets

- Petrol stations and motorway services

- Car parks and multi-storey facilities

- Pubs, theme parks, and farm parks

Crucially, as confirmed in the VOA’s article “How we value properties for business rates: the receipts and expenditure method,” published on 1 April 2025, it also extends to:

- Art galleries

- Museums

- Theatres and cinemas

- Bingo halls

- Marinas

- Zoological gardens and safaris

- Leisure centres

- Sports stadiums

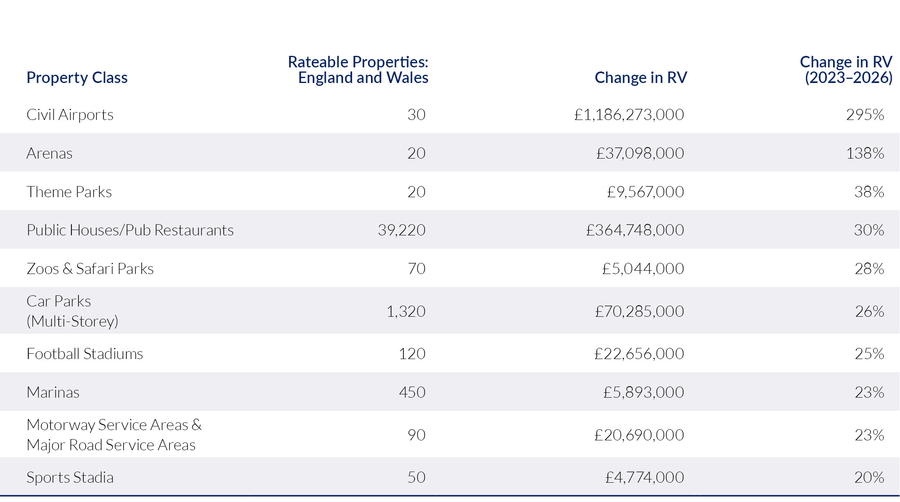

This is now an enormous and diverse category of properties, representing a substantial portion of the tax base. Many appear at the very top of the national league table for 2026 RV increases.

Landmark Cases Raise Red Flags

Recent legal challenges have exposed the weaknesses of the shortened R&E method. In cases like Fryer v. Cox and BlackRock v. Ricketts (VO), the Upper Tribunal has labelled the method “ill-advised” and “prone to errors of judgement.”

Key criticisms include:

- It ignores operational differences: The method fails to account for varying cost structures between businesses, a fundamental flaw in a valuation meant to reflect actual trading conditions.

- It oversimplifies complex factors: Distilling a property's unique attributes and trading prospects into a single numeric factor is unreliable.

The VOA’s continued promotion of this method means a significant portion of the 2026 list is likely to rest on assumptions that do not withstand expert scrutiny. Ryan’s leadership in the landmark BlackRock v. Ricketts case proves that when these assumptions are challenged, they fall apart.

A Reckoning Delayed

The government’s new review signals an acknowledgement of the problem, but it comes too late. Businesses valued using R&E face the full impact of the 2026 revaluation now. Transitional relief may slow the increases, but it will not correct the structural flaws in R&E, especially the widespread reliance on the shortened method. Many businesses could see bills rise by up to 110% over the next three years.

The core issue is that the R&E method has outgrown its policy framework. It was never designed for the broad range of assets it now covers, especially without robust rental evidence and sector-specific data to support its conclusions. The result is a methodology driving extreme outcomes across the entire rating system.

Take Action to Protect Your Business

With the R&E framework under review but unchanged for the 2026–2029 cycle, it is imperative for businesses to act decisively. Do not wait for policy changes that will not provide immediate relief.

Ratepayers whose properties are valued on R&E should:

- Scrutinise VOA calculations: Challenge every assumption made in the VOA’s shortened method calculations for your property.

- Review all evidence: Analyse the trading data, cost structures, and yield evidence used to determine your RV.

- Identify inconsistencies: Compare your valuation against the clear guidance established in tribunal decisions.

- Act early: Address potential inaccuracies now, before the full impact of the revaluation is locked in.

Ryan delivers the UK’s leading R&E valuation expertise. Our unmatched record of successfully challenging VOA assumptions provides our clients with dependable, proven results.

If you believe the R&E method has produced an unrealistic RV for your property, contact our specialist team. We will review your draft list valuation, identify opportunities for a challenge, and quantify potential savings ahead of the 1 April 2026 deadline. Ensure your business is not carrying a valuation built on a potentially flawed foundation.