2026 Business Rates Revaluation for Retail: Market Reality vs. Valuation Outcomes

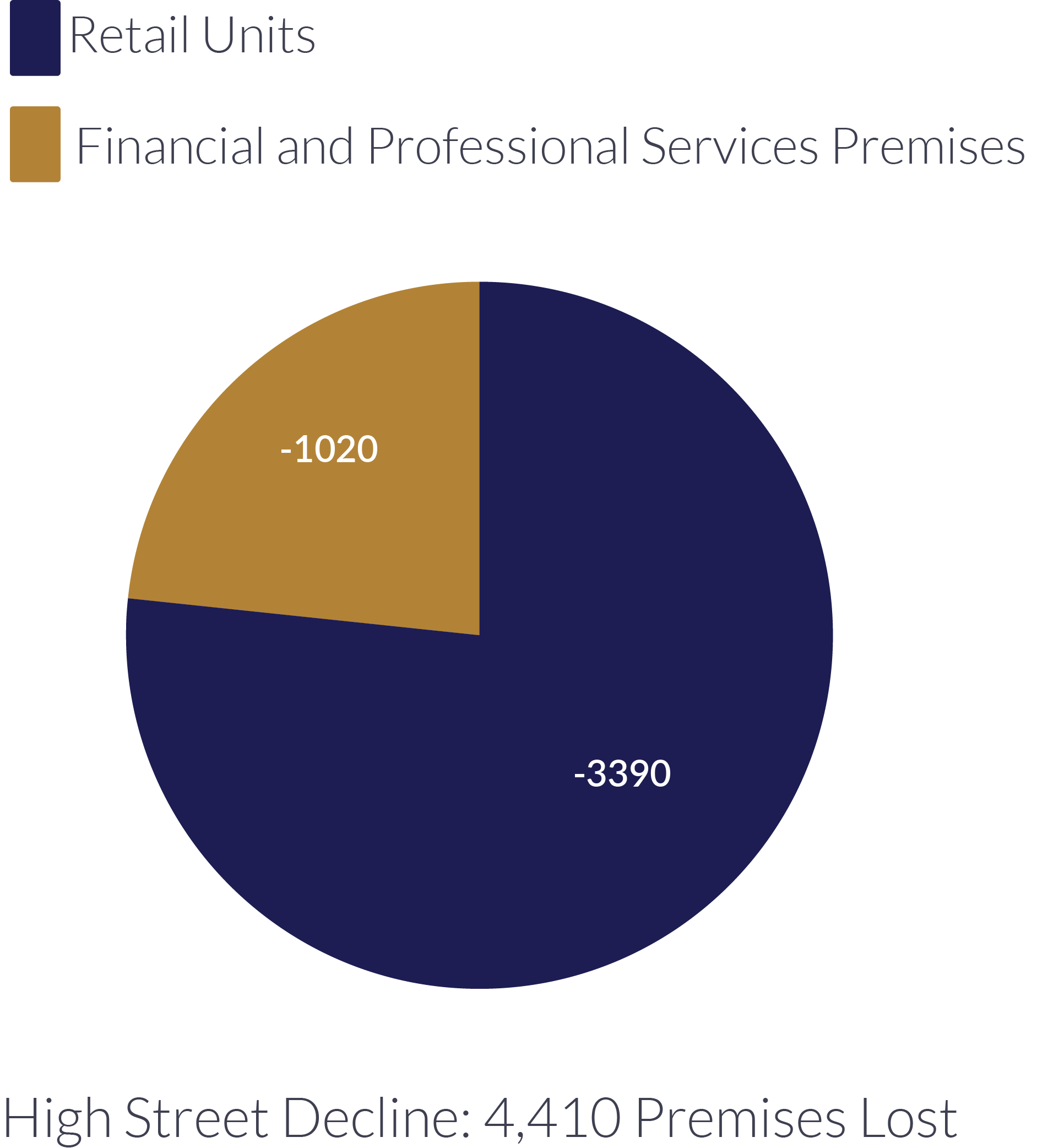

More than 28 high street retail premises a week have disappeared from towns and cities across England and Wales over the past three years. This significant contraction of the high street continues despite a sharp rise in rateable values. A strategic comparison of the 2023 and newly published 2026 draft local rating lists by Ryan identifies a net loss of 4,410 retail premises since November 2022.

2026 Revaluation and the Shrinking High Street

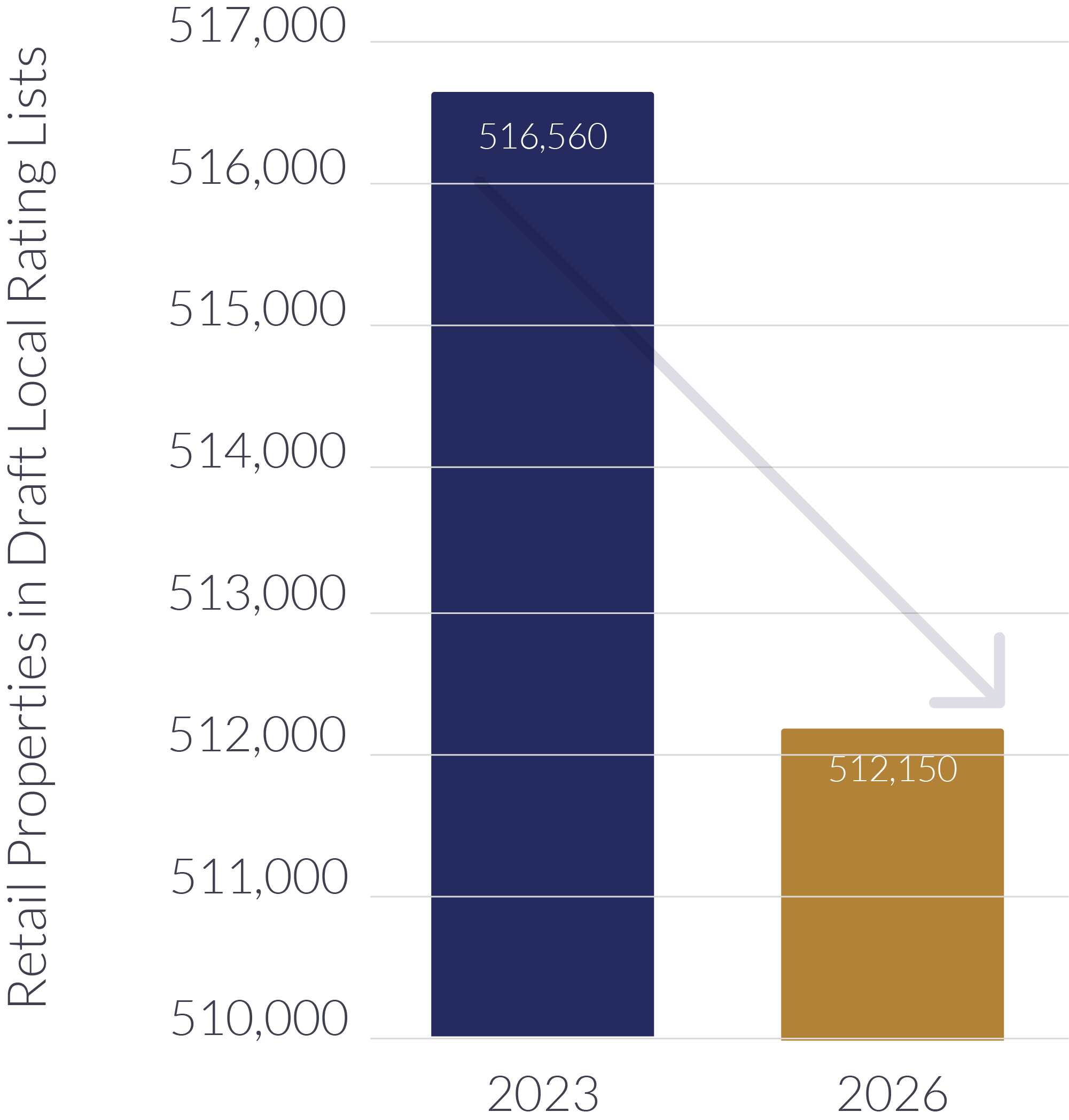

The 2023 draft local rating lists recorded 516,560 retail-classified properties. This comprehensive dataset included:

- 508,300 retail units covering the full breadth of the high street—from supermarkets and pharmacies to florists and charity shops

- 8,260 financial and professional services premises, including banks and estate agents

The 2026 draft local rating lists reveal this total has fallen to 512,150. Specifically, 3,390 retail units and 1,020 financial and professional services premises have vanished. These properties have either been demolished or converted for alternative uses, disappearing permanently from the communities they once served.

The Valuation Office Agency (VOA) Valuation Disconnect: Business Rates vs. Market Reality

This market contraction occurs despite the VOA reporting that overall retail rateable values under the 2026 revaluation of business rates have increased by 9.3%. Based on the 1 April 2024 antecedent valuation date (AVD), values have risen from £14.697 billion to £16.062 billion—an uplift of £1.365 billion.

While this represents the lowest increase of all bulk classes, Ryan's analysis confirms it remains significantly higher than current market conditions justify.

Alex Probyn, Practice Leader, Europe and Asia-Pacific Property Tax at Ryan, questions the alignment between these valuation outcomes and the operational reality for retailers:

“Drawing on thousands of rents analysed between valuation dates, we expected a far more muted revaluation for the retail sector, particularly as many secondary and tertiary high streets continue to show weak rental demand. Instead, the draft local rating lists for 2026 reported a 9.3% rise across England and Wales, creating a growing view that some parts of the sector have been overvalued relative to underlying market evidence.”

Implications for Portfolio Retailers

These findings highlight the persistent structural pressures facing bricks-and-mortar retail. They reinforce concerns that high street recovery remains fragile, even as headline valuations continue to climb.

For enterprise portfolio retailers, this disconnect presents a critical financial risk. It underscores the necessity for rigorous, data-driven checks on rateable values to ensure tax liabilities align with true market value.

Preparing for the 2026 Revaluation

Proactive preparation is essential. To position your business for advantage, you should:

- Review leases and rent reviews to assess evidence that could influence future valuations.

- Check VOA records for any factual errors that may distort your liabilities.

- Model liabilities to project potential changes in rates bills.

- Plan budgets with room to absorb any cost increases.

- Identify properties that may warrant appeals.

The 2026 revaluation presents a window to reset business rates in line with true market conditions. But it also introduces risk for those caught unprepared. The ratepayer’s strongest defence is foresight, rigorous analysis, and partnering early with a professional adviser.

Deadline Approaching: Protect Your Right to a Rebate

On 31 March 2026, the 2023 local rating lists in England and Wales will close. After this date, you will no longer be able to submit a Check, except in the most exceptional circumstances. A successful Check, Challenge, Appeal may secure a reduction in your rateable value and unlock rebates on business rates already paid across three full financial years.

Act now. Consult our business rates specialists to safeguard your position, limit your tax liabilities, and approach the 2026 revaluation with confidence.